In the fast-paced world of industrial manufacturing, acquiring the right equipment is crucial for maintaining competitiveness and ensuring quality production. One such essential investment is financing metal stamping equipment. Metal stamping is a critical process in manufacturing, used to create a variety of products from consumer electronics to automotive parts. Understanding how to finance this equipment can make a significant difference in operational efficiency and financial stability.

Understanding Metal Stamping Equipment

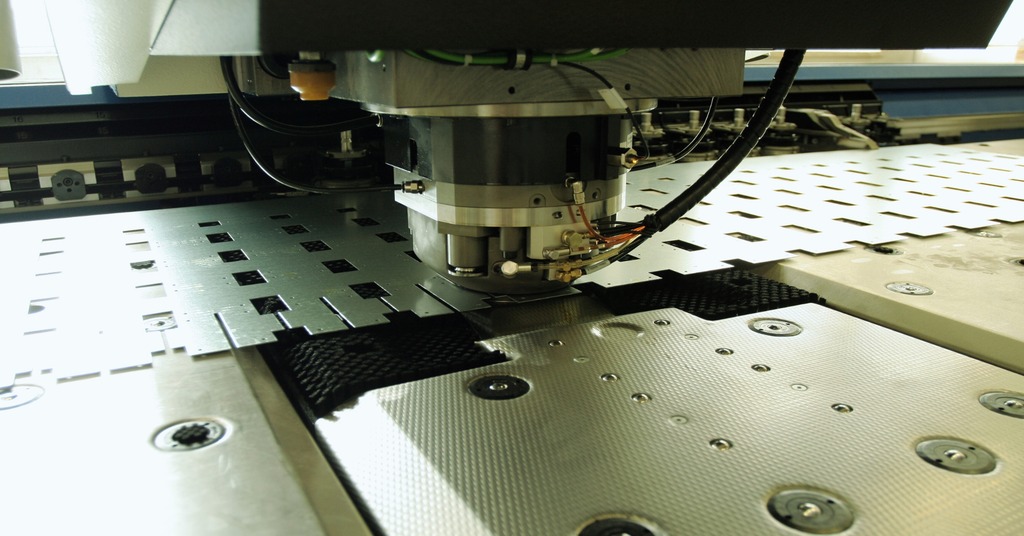

Metal stamping involves a variety of processes like bending, punching, and shaping metal sheets into desired shapes. The equipment required for these processes can be expensive, making financing metal stamping equipment a viable option for many businesses. For a detailed understanding of the metal stamping process, you can visit The Fabricator.

The Importance of High-Quality Equipment

Investing in high-quality metal stamping equipment ensures precision and efficiency in manufacturing. High-quality machines reduce downtime and maintenance costs, ultimately leading to higher productivity. For businesses deciding between used and new equipment, this comparison can provide valuable insights.

Why Finance Metal Stamping Equipment?

Financing offers several advantages, including conserving working capital, maintaining cash flow, and potentially enjoying tax benefits. By opting for financing metal stamping equipment, companies can allocate funds to other critical areas such as research and development or marketing.

Types of Financing Options

There are various financing options available for metal stamping equipment, ranging from leasing to loans. Each option has its pros and cons, and businesses must evaluate these based on their financial health and long-term goals. Learn more about improving productivity with the right equipment at Modern Metalworks.

Leasing vs. Buying

When considering financing metal stamping equipment, the decision often boils down to leasing versus buying. Leasing can lower upfront costs and provide flexibility, while purchasing may offer ownership benefits and potential resale value. This decision should align with the company’s financial strategy and operational needs.

Benefits of Leasing

Leasing allows companies to use the latest technology without the burden of ownership. It can be particularly beneficial for industries with rapidly evolving technology, such as consumer electronics and medical devices.

Understanding Loan Options

Loans are another popular option for financing metal stamping equipment. They often come with fixed interest rates and terms, providing predictable monthly payments. Understanding the different types of loans and their implications on cash flow is essential for making informed decisions.

Secured vs. Unsecured Loans

Secured loans require collateral, potentially offering lower interest rates, while unsecured loans, though easier to obtain, may come with higher rates. Businesses must assess their ability to repay and the level of risk they are willing to take.

Tax Implications of Financing

Financing can have significant tax implications. Interest payments on loans may be tax-deductible, and leasing payments might qualify as a business expense, reducing taxable income. Consulting with a financial advisor can help businesses maximize these benefits.

Depreciation Benefits

Purchasing equipment allows businesses to take advantage of depreciation, which can significantly impact tax liabilities over time. Understanding the nuances of depreciation can aid in making a more informed decision.

Strategic Planning for Equipment Financing

Strategically planning the acquisition and financing of metal stamping equipment is crucial. Businesses should conduct a thorough cost-benefit analysis, considering factors such as equipment lifespan, maintenance costs, and the potential impact on production efficiency.

Aligning Financing with Business Goals

The choice of financing should align with the broader business goals, whether focusing on expansion, improving efficiency, or entering new markets. This strategic alignment is essential for long-term success.

Conclusion

Financing metal stamping equipment is a strategic decision that can drive operational efficiency and financial growth. By understanding the various options and their implications, businesses can make informed decisions that align with their long-term objectives. For further insights into maintaining quality in metal stamping production, visit here.

FAQs

What is metal stamping equipment?

Metal stamping equipment includes machines used to shape and cut metal sheets into specific shapes and sizes, essential for various manufacturing processes.

Why should I finance metal stamping equipment?

Financing can help conserve cash flow, provide tax benefits, and allow businesses to access the latest technology without the high upfront costs of purchasing.

What are the tax benefits of financing equipment?

Financing can offer tax benefits such as interest deductions on loans and potential write-offs for leasing payments, reducing overall tax liabilities.

This article contains affiliate links. We may earn a commission at no extra cost to you.